The Importance of Prioritizing High-Interest Debts: How It Can Accelerate Your Path to Financial Freedom

The Importance of Managing High-Interest Debts

Effective financial management is crucial for anyone aiming to secure their financial future. Among the various strategies available to consumers, the prioritization of high-interest debts stands out as an essential approach that can yield substantial benefits. By directing efforts towards these debts, individuals can not only improve their current financial situation but also pave the way toward achieving their long-term financial goals.

Understanding High-Interest Debts

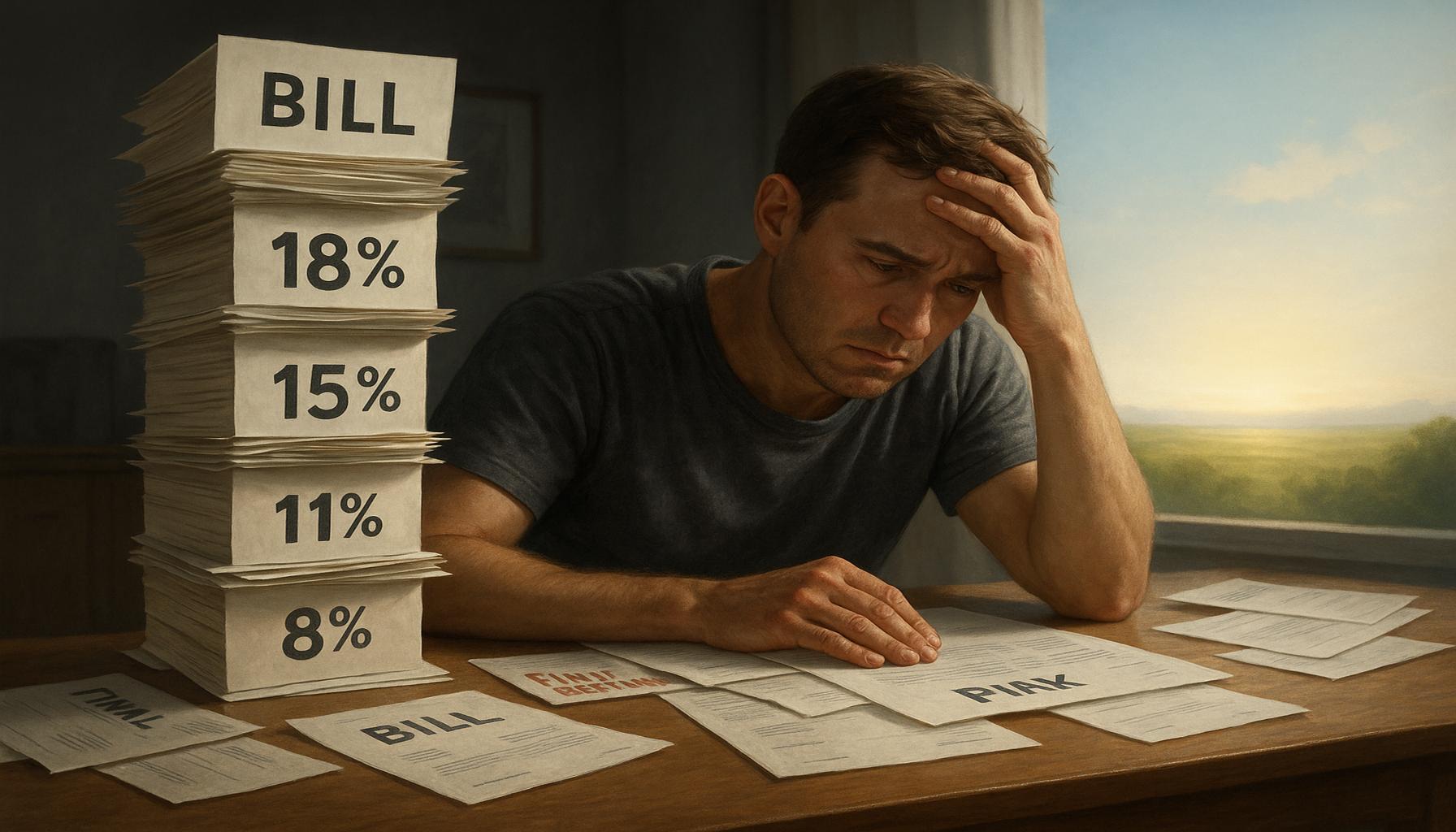

High-interest debts are typically characterized by interest rates that far exceed those of other financial obligations. Common examples include credit card debts, which can carry annual percentage rates (APRs) often exceeding 20%, and payday loans, which may come with shocking fees and rates. If these debts are not managed carefully, they can lead to serious financial difficulties.

Consequences of Ignoring High-Interest Debts

Failing to address high-interest debts can lead to a myriad of adverse effects. For instance:

- Increased financial burden: With high-interest rates, monthly payments can escalate beyond manageable levels, leading to a cycle of debt that becomes increasingly difficult to break.

- Delayed savings: Heavy repayments on high-interest debts can sap disposable income, crippling the ability to save for retirement, emergencies, or planned purchases such as a home.

- Emotional stress: The weight of accumulating debt can result in heightened anxiety, affecting personal relationships and overall quality of life.

The Benefits of Prioritizing High-Interest Debt

On the flip side, confronting these debts can unlock numerous advantages:

- Accelerated debt repayment: By concentrating on high-interest loans, the principal amounts can be reduced more swiftly, leading to lower total interest payments over time.

- Improved credit score: Consistently paying down your debts enhances your creditworthiness, which can contribute to better borrowing terms in the future.

- Greater financial stability: As debts diminish, individuals often find they can create more effective budgets, leading to improved cash flow and greater control over their finances.

Conclusion

Understanding the implications and strategies for managing high-interest debts is critical for all Americans aiming to achieve financial mastery. By prioritizing these obligations, individuals not only alleviate immediate financial strain but also position themselves on a path toward long-term financial independence. This strategic focus on high-interest debt repayment can serve as a fundamental pillar for both improving individual financial health and fostering overall economic stability.

DISCOVER MORE: Click here to learn how to automate your investments

Recognizing the Urgency of High-Interest Debt Management

Addressing high-interest debts promptly is not merely a good practice; it is a critical financial imperative. Understanding the nature and implications of these debts can empower individuals to take decisive action. High-interest debts, particularly those with variable rates or compounded interest, can escalate rapidly, resulting in substantial long-term financial repercussions. For instance, a credit card debt of $5,000 at an interest rate of 20% can accumulate over $1,000 in interest within a year if only minimum payments are made. This example illustrates the importance of addressing high-interest debts without delay.

Why High-Interest Debts Should Be Your Primary Focus

When it comes to debt management, a strategic approach is essential. Prioritizing high-interest debts, such as credit cards and personal loans, offers tangible advantages that can lead you toward financial freedom. The following considerations underscore the necessity of this focus:

- Compound Interest Woes: The impact of compound interest on high-interest debts magnifies the financial burden over time. A $2,000 balance on a credit card with a 24% interest rate can double in just three years if only minimum payments are made, resulting in a staggering financial burden. Early intervention in managing this type of debt is paramount to avoid such outcomes.

- Opportunity Costs: Money tied up in high-interest debt represents a lost opportunity for investment and savings. For example, if you could invest those same funds with a 6% annual return instead of paying down a 20% debt, you could significantly increase your wealth over time. Every dollar allocated towards exorbitant interest payments could otherwise be working towards wealth accumulation or providing for future needs.

- Behavioral Impact: Confronting and managing high-interest debts can also foster a sense of achievement and motivation. Individuals often experience a significant boost in confidence as they pay down debts, which can inspire further financial discipline and healthier monetary habits. This positive reinforcement can lead to improved financial decision-making long beyond the debt reduction period.

Setting Financial Priorities: A Roadmap to Freedom

Establishing a systematic approach to debt reduction can enhance your overall strategy. Here are several steps to guide you in prioritizing high-interest debts effectively:

- Assessment: Begin by compiling a comprehensive list of your debts, noting each account’s interest rate and outstanding balance. This will provide you with a clear picture of where your priorities lie. Understanding how much you owe and the associated costs will help in creating a targeted plan.

- Debt Snowball vs. Avalanche Method: Choose between the debt snowball method, where you pay off the smallest debts first to gain momentum, or the avalanche method, which focuses on knocking down high-interest debts first for cost savings. Each method has its merits, and selecting one that aligns with your emotional and financial situation is crucial.

- Budget Realignment: Review your monthly budget to identify areas where you can cut back, allowing for increased payments toward high-interest debts. This could mean reducing discretionary spending such as dining out or finding alternative income sources like side jobs or freelance work. The aim is to create as much room in your budget as possible dedicated to debt reduction.

Investing time in understanding and managing high-interest debts can significantly impact your financial trajectory. Through methodical assessment, prioritized payments, and conscious budgeting, individuals can swiftly reduce their debt load. Ultimately, this will enable them to channel funds toward savings, investments, and their journey toward financial independence. By taking control of high-interest debts, you not only improve your financial health but also foster a mindset geared towards long-term stability and growth.

DISCOVER MORE: Click here to learn about your best investment options

Effective Strategies for Tackling High-Interest Debt

While awareness of the importance of prioritizing high-interest debts is a vital step, the implementation of effective strategies is equally crucial for achieving financial freedom. Here are several proven tactics that can help you confront and eliminate high-interest debts with efficiency and determination:

Creating a Debt Repayment Plan

A well-designed debt repayment plan acts as a blueprint for your financial recovery. To develop this plan, consider the following steps:

- Monthly Payment Calculations: Determine how much you can reasonably allocate to debt repayment each month. This should include considering your income, essential expenses, and your financial goals. Aim to designate a specific portion of your monthly income to target high-interest debts aggressively.

- Flexible Payment Strategies: Explore options such as the “snowball” method, which emphasizes paying off smaller debts first, or the “avalanche” method, which prioritizes debts based on interest rates. If cash flow allows, consider making further payments on the principal balance to decrease future interest charges. Both strategies possess unique psychological benefits and financial savings.

Negotiating Lower Interest Rates

Another impactful strategy for managing high-interest debts is to seek lower interest rates. The process begins with assessing your current financial standing and reaching out to your creditors:

- Credit Score Check: Before contacting creditors, review your credit report. A strong credit score often strengthens your negotiating position, enabling you to advocate effectively for better terms. In contrast, a poor credit history might hinder these efforts.

- Contacting Creditors: Don’t hesitate to reach out to your creditors and request a reduction in the interest rate. Explain your situation and the promptness of your payments, which could persuade them to offer a more favorable deal. Many credit card companies have programs for hardship assistance, which may provide temporary relief.

The Role of Debt Consolidation

Debt consolidation may also serve as an effective method for simplifying payments while reducing interest rates. This approach involves consolidating multiple debts into a single monthly payment, which can facilitate better financial management:

- Consolidation Loans: Research the possibility of securing a consolidation loan with a lower interest rate than your existing high-interest debts. This can significantly decrease your overall financial burden, making it easier to manage and pay off the debt within a defined timeline.

- Balance Transfers: Investigating promotional balance transfer offers can provide likewise advantages, particularly for credit cards. Many companies offer low or zero-interest promotional rates for a limited time, allowing substantial savings if the debt is paid off within that period.

Emergency Funds and Savings Considerations

While it is essential to prioritize high-interest debt repayment, having an emergency fund can prevent future financial pitfalls. Here’s how to approach this balance:

- Initial Savings Goals: Aim to accumulate a small emergency fund, typically between $500 to $1,000, to cover unforeseen expenses. This fund can protect you from new debt accumulation when unexpected costs arise during the repayment process.

- Long-Term Savings Strategy: As your high-interest debts decrease, gradually allocate a portion of your budget to building a more substantial emergency fund that covers at least three to six months’ worth of living expenses. This practice ensures that you are not only focused on debt reduction but also investing in your future financial security.

Implementing these strategies to tackle high-interest debts requires a commitment to disciplined financial habits. By creating structured repayment plans, negotiating lower interest rates, considering consolidation options, and maintaining an emergency fund, individuals can progress steadily towards financial freedom. Each step taken diligently not only reduces financial stress but also lays the groundwork for a more secure and prosperous future.

DISCOVER MORE: Click here for practical money-saving tips

Conclusion

In conclusion, prioritizing high-interest debts is not merely a recommendation but a necessity for achieving financial freedom. As highlighted earlier, high-interest debts, such as credit card balances and payday loans, can create a burdensome financial cycle that prolongs the journey to economic stability. For instance, the average credit card interest rate in the United States is around 16%, and if left unchecked, this can lead to significant financial strain over time. By addressing these debts first, individuals can significantly reduce the total interest paid over time and regain control over their financial lives.

Implementing targeted strategies such as crafting a comprehensive debt repayment plan is essential. This can involve the use of methods such as the avalanche or snowball techniques, where one either pays off the highest-interest debt first or the smallest debt first, respectively. Additionally, negotiating for lower interest rates with lenders can be a viable tactic; many financial institutions are willing to re-evaluate terms, especially for loyal customers or in light of improved financial circumstances. Moreover, utilizing debt consolidation—such as obtaining a personal loan with a lower interest rate to pay off higher-interest debts—can streamline the repayment process, making it both manageable and effective.

Furthermore, maintaining a small emergency fund, ideally at least $1,000, while paying off high-interest debts can serve as a safeguard against unforeseen expenses, ultimately preventing the cycle of debt from reemerging. This proactive approach reduces the likelihood of needing to rely on high-interest loans in emergencies, which can exacerbate existing financial difficulties.

Ultimately, adopting a proactive and disciplined approach to managing high-interest debts empowers individuals to break free from financial constraints and cultivates a pathway to long-term wealth accumulation. With determination and strategic planning, one can transform a challenging financial landscape into an opportunity for growth and stability. As you embark on this journey, remember that every step taken towards addressing high-interest debts is a step closer to achieving financial independence and peace of mind.

Beatriz Johnson is a seasoned financial analyst and writer with a passion for simplifying the complexities of economics and finance. With over a decade of experience in the industry, she specializes in topics like personal finance, investment strategies, and global economic trends. Through her work on True Metronome, Beatriz empowers readers to make informed financial decisions and stay ahead in the ever-changing economic landscape.