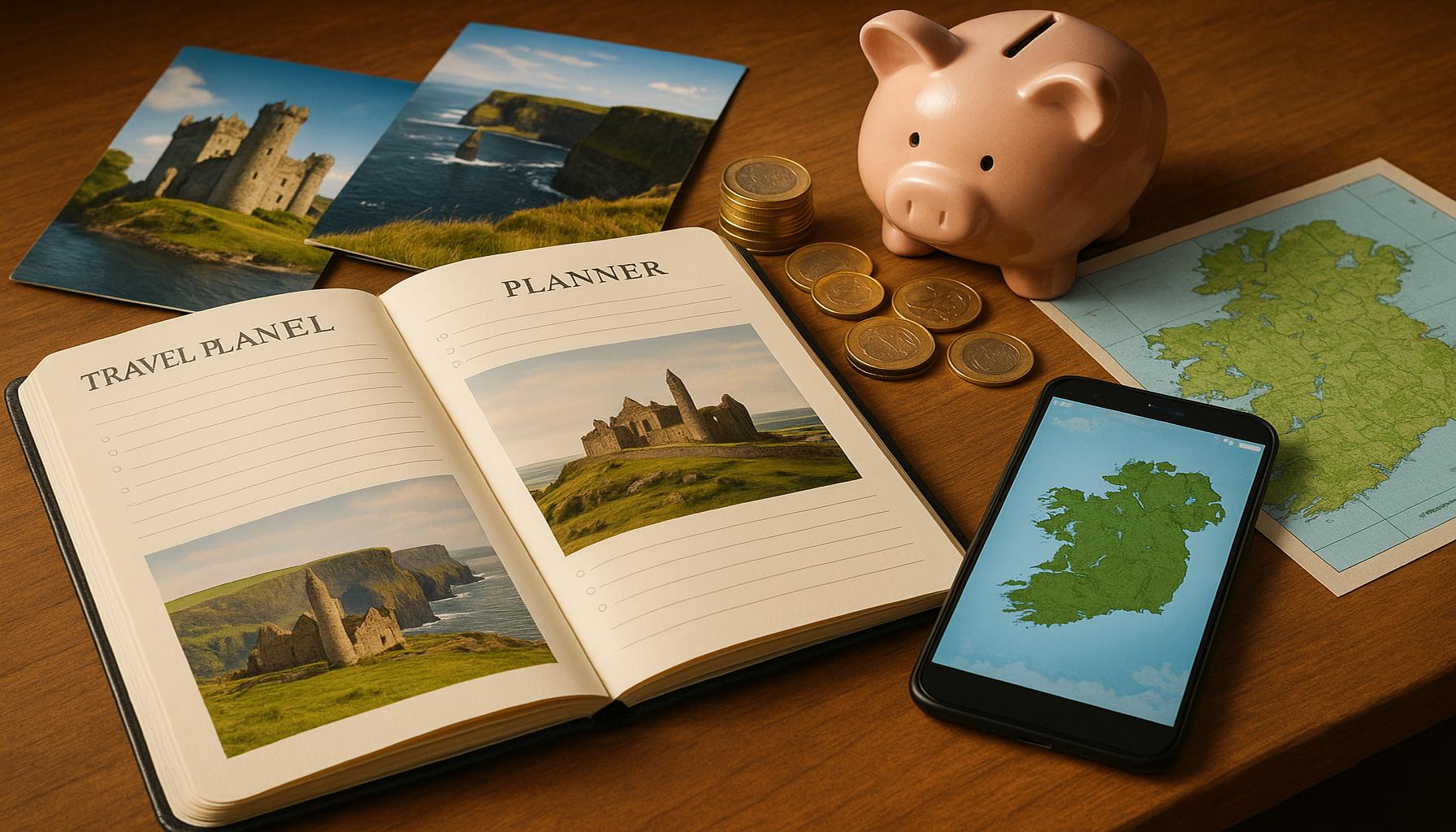

Financial Planning for Travel: How to Save to Explore Ireland

Understanding Financial Planning for Your Irish Adventure

Traveling to Ireland not only offers breathtaking views of the rugged coastlines and lush countryside but also presents an opportunity to immerse yourself in its rich heritage and literary history. However, to avoid financial stress during your travels, meticulous financial planning is non-negotiable. With careful preparation, you can explore Ireland without exceeding your budget, making the most of your experience.

Budgeting: A Foundational Step

Establishing a clear budget is a fundamental step in financial planning for your trip. Create categories that cover essential expenses such as accommodation, transportation, meals, and leisure activities. Begin by estimating costs based on your preferences and travel style.

For instance, if you plan to stay in Dublin and visit places like the Guinness Storehouse or Trinity College, allocate funds for admission fees, transport costs such as bus fare, and daily dining. A well-structured budget allows you to anticipate expenses and adjust accordingly before and during your trip.

Setting Savings Goals

To ensure your financial readiness, set specific savings targets well before your trip. This entails figuring out how much you will need and devising a plan to reach that amount. For example, if your target is to save €1,500 and you have six months until your departure, aim to save €250 each month. Consider redirecting funds from discretionary spending, such as dining out or entertainment, towards your travel fund.

Implementing Cost-Saving Strategies

Employing cost-saving strategies can significantly decrease overall expenses. Look for flight deals on comparison websites, as there can be substantial savings by choosing less popular travel times or booking well in advance. Utilize platform tools that offer fare alerts, ensuring you snag the best deals available.

Accommodations can vary from luxury hotels to more budget-friendly options like hostels or Airbnb rentals. Research different lodging arrangements and consider splitting costs with travel companions for a more economical stay.

Moreover, take advantage of loyalty programs or discounts for services such as car rentals or guided tours. Many attractions, such as the Cliffs of Moher, also offer reduced rates for booking online ahead of time.

Anticipating Key Expenses

Understanding potential costs associated with traveling in Ireland is a vital part of your planning. Airfare can fluctuate significantly based on the season. While summertime sees a spike in prices, traveling in spring or fall often yields more affordable options.

Regarding accommodation, varying your choice between hostels, hotels, or homestays can greatly affect your budget. Additionally, exploring free activities, such as visiting the vast landscapes of Killarney National Park or enjoying local festivals that happen throughout the year, can enrich your experience without impacting your wallet.

In summary, approaching your trip to Ireland with comprehensive financial planning will enable you to enjoy its charm and natural beauty sustainably. A thoughtful strategy not only mitigates stress but also maximizes the potential for unforgettable memories while adhering to your financial limits. By mastering your budgeting, savings, and cost-saving techniques, you can ensure a pleasurable adventure on the Emerald Isle without compromising financial security.

DISCOVER MORE: Click here to find out how to pay off credit card debt faster

Essential Elements of Financial Preparation for Exploring Ireland

When planning a visit to Ireland, a stunningly picturesque destination, it is crucial to incorporate comprehensive financial planning to ensure your trip is both enjoyable and financially sustainable. Beyond simply setting aside funds, taking a strategic approach to your finances will provide a solid foundation for your travel experiences. This section delves into essential elements that should form the backbone of your financial preparation.

Creating a Detailed Travel Itinerary

First and foremost, crafting a detailed travel itinerary is vital for effective financial planning. Knowing which cities and attractions you plan to visit helps you to estimate costs more accurately. For example, if you intend to travel from Dublin to Galway and then to Dingle, outline the key expenses associated with each leg of your journey. This includes transportation costs such as intercity bus fares or car rental fees, as well as planned accommodation and activities in each location.

A well-organized itinerary not only facilitates budgeting but also allows you to identify potential savings. For instance, researching free or low-cost events happening during your visit can add value to your itinerary without negatively impacting your funds.

Prioritizing Essential Expenses

Identifying and prioritizing your essential expenses is a core component of your financial plan. Here are the primary categories that should dominate your budget:

- Accommodation: Research options ranging from hostels, hotels, and B&Bs to short-term rentals, considering factors such as location and amenities.

- Transportation: Factor in local transportation expenses, including public transit, taxis, or fuel costs if you choose to drive.

- Food and Drink: Dining can vary significantly in cost—budget for three meals a day, factoring in options like self-catering or enjoying traditional Irish meals at local pubs.

- Attractions and Activities: Set aside a budget for entry fees to attractions, guided tours, and any extracurricular activities you may wish to indulge in.

By categorizing your expenditures, you can monitor your spending closely and make adjustments where necessary, ensuring you remain within your budgetary limits.

Exploring Financial Avenues for Savings

Another crucial aspect of financial planning for travel is identifying various financial avenues that can facilitate your saving goals. Here are some effective strategies to consider:

- Automated Savings Plans: Set up an automatic transfer to your designated travel savings account from your primary account each month, ensuring consistent contributions.

- Utilize Cashback and Discount Programs: Take advantage of cashback websites and apps to earn rebates on purchases, subsequently allocating these savings to your travel fund.

- Consider Side Income Opportunities: Engage in part-time freelance work or a side gig to significantly augment your savings over time.

By understanding and applying these financial strategies, you will enhance your preparation for traveling to Ireland, transforming your savings into an enriching journey rather than a source of financial concern. A disciplined focus on your expenditures and a proactive savings strategy will pave the way for unforgettable experiences as you explore the captivating landscapes and vibrant culture of the Emerald Isle.

DISCOVER MORE: Click here for a step-by-step guide on applying for a Santander personal loan</a

Leveraging Tools and Resources for Effective Financial Planning

With the various aspects of travel budgeting in mind, it is essential to utilize the right tools and resources to optimize your financial planning process. The digital age has made financial management more straightforward and accessible, providing a plethora of applications and websites designed to aid travelers in budgeting effectively. This section explores some essential tools, resources, and strategies that can support your financial planning journey.

Budgeting Apps and Financial Trackers

One of the most significant advantages of modern technology is the availability of budgeting applications and financial trackers. These apps not only help you monitor your general expenditures but also enable you to build a detailed travel budget specifically tailored for your Ireland trip. Popular applications such as Mint, YNAB (You Need a Budget), and EveryDollar offer user-friendly interfaces that help categorize expenses and track spending habits over time.

Additionally, features such as goal setting and financial forecasting allow you to view your progress against your intended saving goals, thereby providing encouragement and accountability. Setting a specific savings target for each month in alignment with your travel plans will further ensure you are prepared for your Irish adventure.

Currency Conversion and Exchange Rate Considerations

When traveling to Ireland, understanding currency conversion is paramount to effective budgeting. The Euro (€) is the official currency in the Republic of Ireland, and fluctuating exchange rates can significantly impact your travel budget. Before you embark on your journey, consider investing time in researching current exchange rates to identify the most favorable time to convert your currency. Online currency converters and apps, such as XE Currency Converter, can provide real-time updates on rates, helping you make informed decisions regarding when and where to exchange money.

Furthermore, avoid currency exchange kiosks at airports or tourist sites where fees can be exorbitantly high. Instead, opt for withdrawing cash from ATMs, which often provide better rates. Most banks also offer international debit or credit cards with minimal foreign transaction fees eliminating unnecessary costs from your budget.

Travel Insurance as a Financial Safety Net

Incorporating travel insurance into your financial plan while exploring Ireland is not merely a safeguard against last-minute changes or medical emergencies; it is also a fundamental aspect of protecting your monetary investment in the trip. Choose a comprehensive travel insurance policy that covers trip cancellations, lost luggage, and medical expenses, especially if participating in activities such as hiking along the Cliffs of Moher or visiting remote areas. This step can save you from unpredictable financial burdens that could derail your budget significantly.

Dining and Entertainment Savings Strategies

The culinary landscape in Ireland is both vibrant and diverse, which can range from affordable hidden gems to high-end dining experiences. To help manage costs while enjoying authentic Irish meals, consider these strategies:

- Lunch Specials: Many restaurants offer enticing lunch menus at reduced prices compared to dinner. Consider dining out during lunch hours to enjoy local fare without overspending.

- Self-Catering Accommodations: Opt for accommodations with kitchen facilities which allow you to prepare some meals, reducing reliance on dining out.

- Explore local markets: Visit local farmers’ markets and food stalls for fresh produce and artisanal foods, often at lower prices than traditional supermarkets.

By implementing these considerations into your financial planning, you will create a multifaceted strategy that simplifies the complexities of budgeting in preparation for your Irish travels while ensuring an enriched and well-managed experience.

DISCOVER MORE: Click here to delve deeper

Conclusion

In conclusion, effective financial planning is integral to transforming your dream of exploring Ireland into a reality. By establishing a detailed budget and adhering to it, travelers can ensure their finances remain on track while still enjoying the unique experiences that Ireland has to offer. Utilizing budgeting tools and applications can provide structure and clarity, enabling you to monitor your progress towards your savings goals. Understanding currency conversions and exchange rates will further protect your budget from potential pitfalls related to international transactions.

Moreover, incorporating travel insurance serves as a vital safety net, mitigating financial risks associated with unforeseen events. As for dining and entertainment, leveraging local opportunities and making considered decisions about when and where to indulge can significantly improve your overall budget. By prioritizing experiences such as enjoying lunch specials or choosing self-catering accommodations, you enhance your trip’s enjoyment while keeping costs manageable.

Ultimately, successful financial planning for your Irish adventure requires a balance of discipline and flexibility. It is essential not only to save but to allocate your resources in a way that enriches your travel experience. By following the strategies outlined in this article, you are well on your way to exploring the captivating landscapes, rich history, and warm hospitality of Ireland without abandoning your financial responsibilities. Embrace the journey ahead with confidence, knowing that thorough preparation leads to unforgettable experiences.

Beatriz Johnson is a seasoned financial analyst and writer who is passionate about simplifying the complexities of economics and finance. With over a decade of industry experience, she specializes in topics such as personal finance, investment strategies, and global economic trends. Through her work at True Metronome, Beatriz empowers readers to make informed financial decisions and stay ahead of the curve in an ever-changing economic landscape.